Go to the OSD website for liquidation orders. What happens if an insurer goes bankrupt.

Requesting the insured swear under oath concerning the facts of the claim 2.

. If an insurance company or a group workers compensation trust becomes insolvent the Illinois Department of Insurance Office of the Special Deputy takes over the company and performs the receivership duties. Transferring risk away from the business and over to an insurer credit insurance protects the policyholder in the event of a customer becoming insolvent or failing to. The limits of your coverage for the following are typically a set percentage of your dwelling coverage limit as shown below.

With trade customers holding the potential to both make and break a business financial protection is top of the agenda for most business owners and this is precisely the role of credit insurance. A claims adjuster advises the insured that if the claim goes to arbitration the insured would probably receive less. It is the intention of the Parliament that if this Act requires or permits an act or thing to be done by or in relation to a person with disability by another person the act or thing is to be done so far as practicable in accordance with both the general principles set out in section 4 and the following principles.

C For any claim submitted to an insurer on the current standard Health Care Financing Administration UB-92 health insurance claim form or its successor if the following information is completed and received by the insurer the claim may not be deemed to be deficient in the information needed for filing a claim for processing pursuant to subparagraph B of. 1 For the purposes of paragraph d of the definition of supervised legal practice in section 61 of the Uniform Law supervised legal practice in the case of an Australian legal practitioner who is an employee of a law practice or who though not an employee of the law practice is working under supervision in a law practice includes supervision by an employee of the law practice. The policy will come into effect only if a builder dies cannot be located or becomes insolvent.

The settlement of the claim is delayed for 30 days in order for the insured to conduct an investigation 3. No insurer or agent shall refuse to issue an automobile insurance policy as defined in Section 38-77-30 solely because of any one of the following factors. The previous refusal of automobile insurance by another insurer prior purchase of insurance through the Associated Auto Insurers Plan or lawful occupation including the military service of the person seeking the coverage.

When shopping for homeowners insurance the type of coverage you choose will have an impact on your rates. Texas homeowners have a. When default judgment against car driver allegedly driving with permission of.

It is the intention of the Parliament that if this Act requires or permits an act or thing to be done by or in relation to a person with disability by another person the act or thing is to be done so far as practicable in accordance with both the general principles set out in section 4 and the following principles. In all other cases a builder will remain responsible for claims made by an owner or successive owners during the six year period following practical completion. Personal property 50.

The payor rider on a juvenile life policy provides that if the payor dies or becomes disabled before the insured juvenile reaches the age specified on the policy. The cover does not reduce the liability of a builder during the six year insurance period. The insureds estate will make the premium payments.

The insurer will make the payments until the insured juvenile reaches the specified age. How much is home insurance in Texas. An insolvent tortfeasor may not by his breach of contract of insurance bar the action granted to an injured person against an insurer where the breach of contract does not prejudice the insurer.

Which of the following would be considered an unfair claims settlement practice. The insurer will lend money to keep the policy in force. 2 Where a person who is insured under a policy issued for the purposes of this Chapter has become insolvent or where if such insured person is a company a winding up order has been made or a resolution for a voluntary winding up has been passed with respect to the company no agreement made between the insurer and the insured person after the liability has been.

Loss of use 20. A judgment creditor may be subrogated to the insureds rights. Other structures 10.

Solved 1 Which Of The Following Is A True Statement Chegg Com

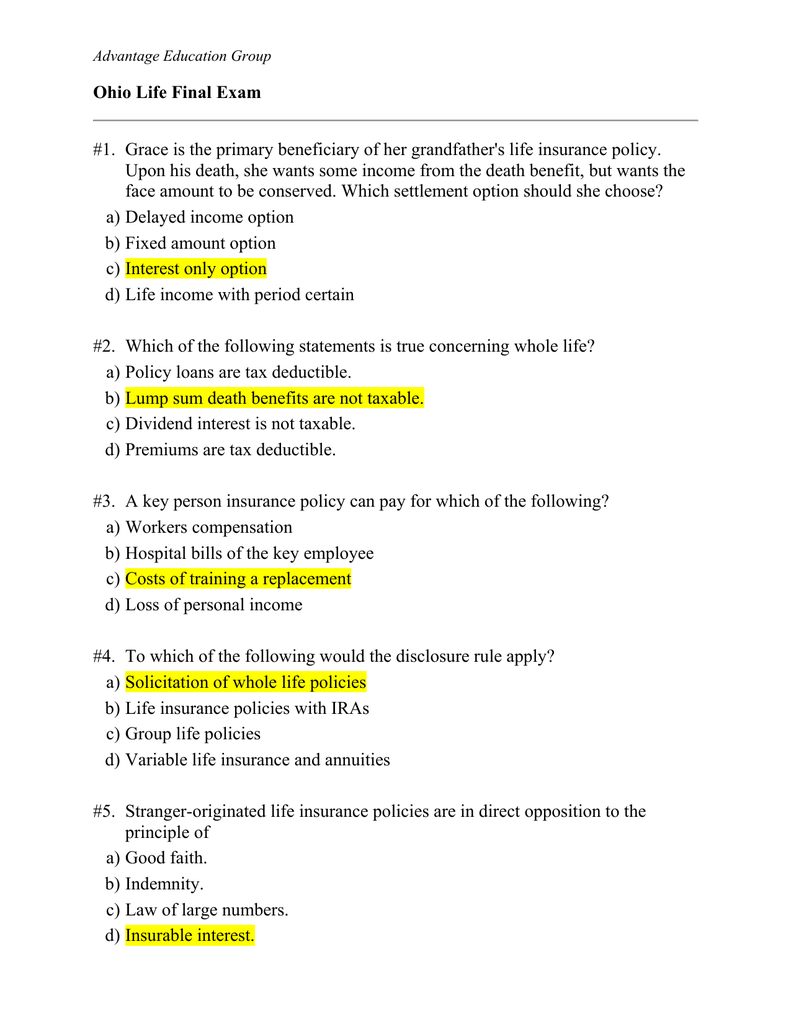

Advantage Education Group Ohio Life Final Exam Pdf Free Download

0 Comments